Financial Analysis of Competitive Drugs with PharmaKB

Key Takeaway

The Pharmaceutical KnowledgeBase (PharmaKB) provides multidimensional content to strategically assess and compare the relative virtues of competing commercial drug franchises.

The pharmaceutical industry races to discover, develop, produce, and market superior medications. The medications are differentiated by their effectiveness, safety profiles, side effects and ease of use. Given the high value of successful drugs and the corresponding high risk of drugs that fail, financial investors and pharmaceutical industry leaders utilize the salient information in PharmaKB.com to make superior investment and product development decisions.

The Pharmaceutical KnowledgeBase™ was created by Collaborative Drug Discovery (CDD) It’s available at www.pharmakb.com with supplemental information available upon request on GitHub.

PharmaKB provides extensive current information for pharmaceutical leaders and financial investors to evaluate competing commercial drug programs.

All drugs, diseases, and targets use standardized terms in PharmaKB.com to ensure “apples to apples” comparisons - both within PharmaKB and across other databases. Here we show examples comparing similar drugs by standardized terms (diseases, targets, etc.) to provide competitive intelligence and early indicators of future drug revenues from PharmaKB data.

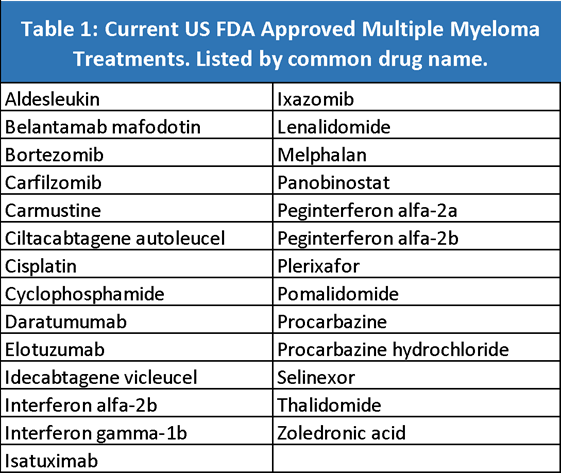

Table 1 illustrates all current drugs approved by the US FDA for treatment of Multiple Myeloma - a serious cancer with an average survival rate of ~5 years.

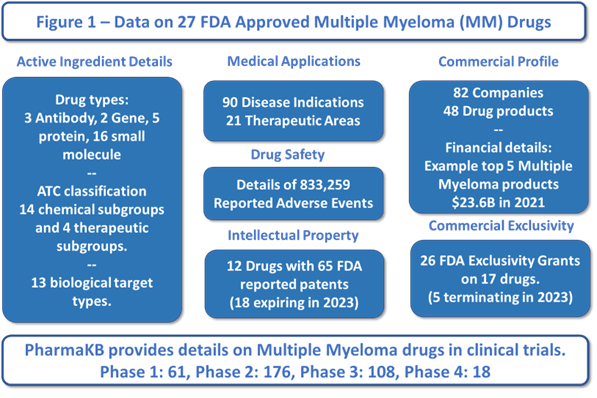

Figure 1 provides a summary infographic of the 27 FDA approved drugs for Multiple Myeloma. Of note are the competitive targets, adjacent market extensions, safety, financial, and scientific trends - updated daily.

This information is available for all FDA and EMA approved drugs and drugs in clinical trials (for all diseases, not just for multiple myeloma).

Comparing specific Multiple Myeloma drugs using PharmaKB data.

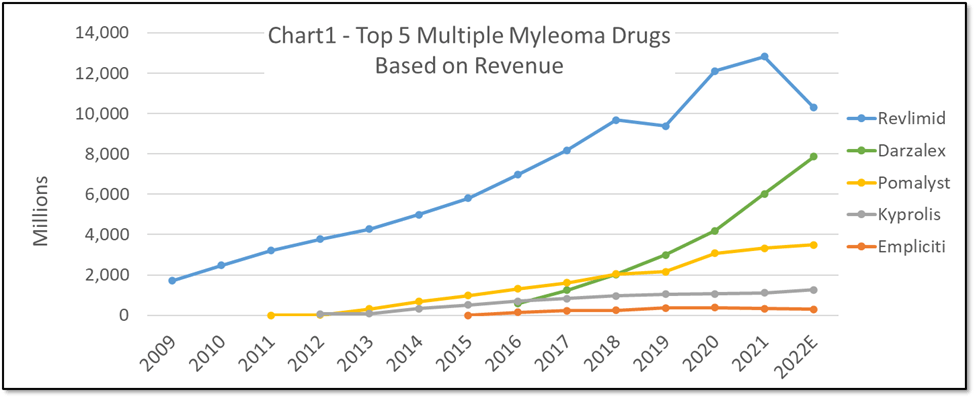

Chart 1 provides a summary of the quarterly (and thus annual) revenues derived from the top 5 FDA approved drugs for treating multiple myeloma.

Analysis

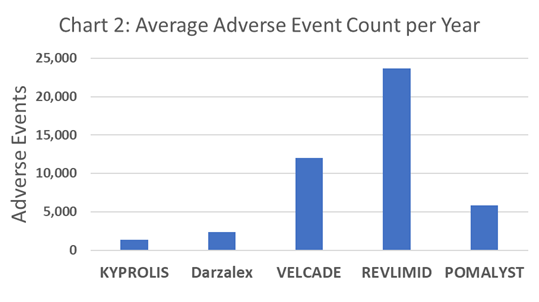

Chart 1 shows the historically stronger market performance for Revlimid, in comparison to other top drugs in the Multiple Myeloma market. However, since q3-2021 Revlimid revenue consistently decreased on a quarterly basis while Darzalex revenue has consistently increased in the same period. Darzalex had been increasing steadily prior to the trajectory turn in Revlimid revenues. Whether correlation or causation, researchers can look deeper into the PharmaKB.com database to glean other early indicators of these trends for Revlimid vs Darzalex (clinical trial outcomes, adverse events after approvals, literature trends, etc.). For example, Chart 2 illustrates the relatively low incidence of Adverse Events for Darzalex in comparison to Revlimid (as reported by doctors).

In contrast, a historically positive aspect of Revlimid in comparison to Darzalex is the relative simplicity in administration of Revlimid as an oral drug versus Darzalex via intravenous administration. However, slightly before the fortunes reversed, back in 2020 the FDA approved Darzalex Faspro - a version of this drug that can be administered via subcutaneous injection. This formulation provided an additional compelling reason for clinicians to consider Darzalex Faspro, since it reduced the treatment time and number of shots.

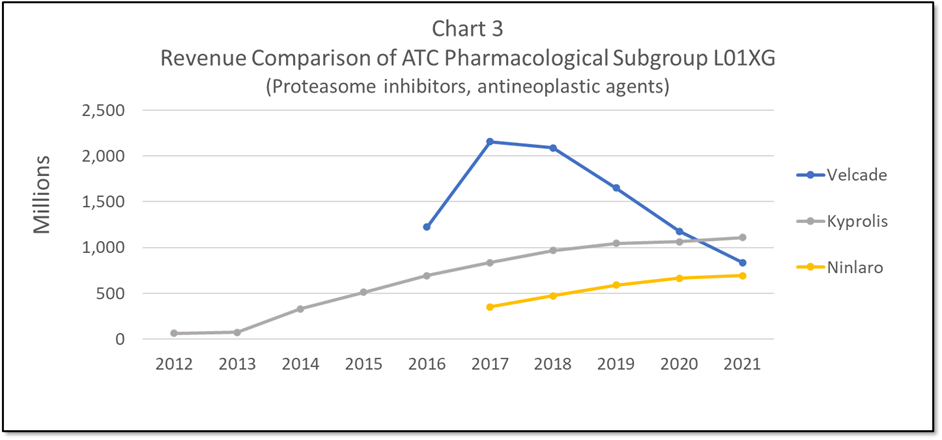

In addition to looking at drugs competing by their standardized disease terms, experts can dig deeper to compare drugs hitting the exact same standardized target. For example, both Kyprolis and Velcade are Proteasome inhibitors - a novel mechanism of action. These two drugs compete more directly (see Chart 3). Similar competitive dynamics are observed in this more specialized arena - specifically Kyprolis (best in market over time) shows significantly less adverse events than Velcade (first to market).

In response to the competitive pressure from Kyprolis, the originator of Velcade (Millennium, now Takeda) approved a next generation proteasome inhibitor Ninlaro (ixazomib). In contrast to the earlier proteasome inhibitors given by injection, Ninlaro is taken by mouth in the form of capsules, was granted orphan drug status in the USA and Europe and is used in combination with Revlimid and Dexamethasone.

All these dynamics and more are tracked daily, with material impact for future company revenues and for human health. In our humble way with the automated technologies, we help investors, researchers, and patients stay on the pulse of emerging dynamics across all companies, drugs, and diseases (coincidentally another CDD acronym).

For information on Collaborative Drug Discovery’s Pharma KnowledgeBase (PharmaKB):

All content is available through the PharmaKB web application at (www.pharmakb.com) or via the PharmaKB API (details at https://www.pharmakb.com/api-documentation).

Email: info@pharmakb.com